Why women need to buy insurance more than men

Are women naturally better than men when it comes to money? Women today are taking up leading roles in finance and banking sector.

Are women naturally better than men when it comes to money? Women today are taking up leading roles in finance and banking sector.

Four out of top five banks in India are led by women. Forbes has placed Arundhati Bhattacharya, the first women to have served as Chairman of India’s biggest public sector bank, as 25th most power woman in the world.

Chanda Kochhar and Shikha Sharma, heading two of the biggest private banks in India, are some of the most influential women in Indian Banking.

Ironically, when it comes to investing for their own self, women are scared. Most of the women are confident in managing their day-to-day budgeting but are not too comfortable discussing money with family.

Investment firm Fidelity Investments says majority of the women hold back when it comes to talking about money. In a study, eight out of 10 women confessed they have refrained from discussing their finances with those they are close to. Around 56 percent respondents in the study found it too personal to discuss. About one third of them said they didn’t want to disclose the information regarding their investments.

Also, a significant number of women said, they were not raised to talk about finances. Sometimes, women do not feel confident enough to talk about their financial decisions, according to Fidelity Investments Money FIT Women Study 2015.

Discussing money with family is not part of our culture. In India, women may be on good positions at work but for security, most of them still look at their fathers or husband. Social security is essentially associated with marriage. Parents invest for daughter’s wedding day not necessarily for her future.

Women are taught to take entire household’s responsibility since childhood. For them, this hesitation to talk about money extends beyond family and friends.

Even the commercials revolve around the women of the house. From mosquito repellents to hand wash and toothpaste, it seems only the woman’s concern. The man is portrayed as someone who earns and buys a life insurance for wife to achieve the goals, he had set while he was alive.

Health insurance companies consider women a higher risk than men because they are more likely to have chronic health conditions. They tend to visit the doctor more frequently, live longer, and have babies.

Women generally have a tendency to procrastinate when it comes to taking a financial decision. They are so busy juggling home and office, they tend to forget themselves.

There are only a handful of social welfare schemes for women in India, mostly associated with maternity benefits. When it comes to private healthcare services, women sometimes have to pay more.

See the irony, women in India earn 25 percent less than men. According to a recent Monster Survey, the gender pay gap is highest in manufacturing. Followed by IT, Banking & Financial and Education & Research sector.

Despite the odds, women from all walks of life multitask all the time. Unfortunately, they are not very cautious of their health. Increasing heart-related diseases, gestational diabetes, cancer, reproductive health, depression are just some of the reasons why women in India need to opt for health insurance at the earliest. With pollution, adulteration and lifestyle diseases showing an upward trend, infertility treatments have become quite common, putting a dent in any family’s financial health.

Health insurance planning cannot be ignored and should be done as early as possible. Healthcare needs are same for working as well as non-working females. But reality is just the opposite.

“Individual health plans are not popular among females. Women are mostly covered in family floaters in policies held by husband. As a rarity, divorced or single mothers go for individual mediclaim plans,” says Vinay Taluja, EVP & National Head, Landmark Insurance.

Normally, floater policies allow coverage for dependent children till the age of 21. If the women decides to work, she gets an insurance coverage from her respective company. But if she stays at home till she finds a suitable match, her parents leave the health expenses on the future husband.

When it comes to premiums, it’s not surprising that women have to shell out more for the same sum insured. “Women have greater longevity and are at a higher risk. Health insurance companies calculate the premium on the basis of their past claim settlement ratios. Recently, all the insurance companies’ premium rates have risen 20% due to recurrence of claims” says Poonam Rungta, Financial Expert and CEO, LJ Business School.

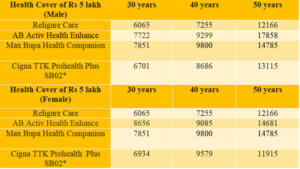

See Illustration below for Online Health Insurance plans.

*Sum Insured in Cigna TTK Health Insurance- PROHEALTH PLUS SB02 policy INR 5.5 Lakh

Source: Policy Bazaar

Talking about life insurance, companies are not that keen on selling policies to home-makers and self-employed females. For insurers the risk of the individual is derived through human life value (HLV) concept, in terms of financial obligation.

“The risk attached to the family’s bread earner is the maximum. The HLV of the bread earner is a declining graph, as the age increases, it becomes zero by the time he reaches retirement. The financial contribution towards his family is minimum. Hence, a sum is to be paid towards his risk cover in the form of premium,” says Poonam Rungta.

Life insurance is directly related with the age and income of the policyholder. Making it unlikely for a home-maker to get one. “A housewife has comparatively low human life value in terms of financial contribution to her family. As a financial planner, I do not recommend high sum assured plans like term cover for her. If the housewife does not have an income of her own, insurance will be granted as per minimum allowed by IRDA or equal to husband’s insurance. A conventional plan with long term i ..

But a woman’s death is far more than a financial loss for the family. The absence of the female member may result in a void which may not be easy to fill. The husband may have to allocate separate funds for house help, tutor, day care, etc. In case he gets married for the second time, he will have to incur some more expenses.

“Not many females come up and buy life insurance for themselves. Females whether earning or not, both have a notional human life value,” feels Vinay Taluja.

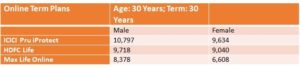

Infact, premium rates for females are two years lesser as compared to males due to lower mortality rate. See illustration below:

The problem is not just with the awareness levels but also the way we have been brought up. Piya (name changed), IT Professional and mother of four-year old, says she never thought of buying a life insurance while she was working. She’s now on a sabbatical. Although, she has a health insurance which includes the nuclear family.

“Women don’t really participate when it comes to money matters. They leave everything to the husband. Even the insurance companies portray men as the breadwinner in all their advertisements,” she laments.

Garima (name changed), Associate Professor with a private university, is single and thinks every woman should buy life insurance for herself. “Insurance has nothing to do with your marital status. If you are earning, you should opt for term plans. Even the health policies provided by employers are not tailor-made. Relying only on group plans can be harmful at times, better to go for individual mediclaim plans as per your need,” she feels.

Women need to focus on themselves before the alarm bell rings because they run the family in many ways. Women health issues are different as compared to men and need special attention. But sadly, very few women give importance to their own health. For majority of their lives, they remain ignored, dependent or busy playing hide and seek between home and office.

source:economictimes